Bull Market Quotes

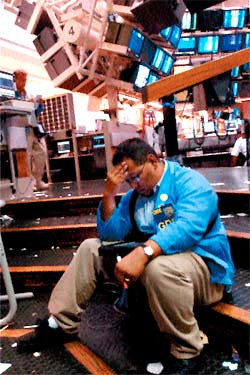

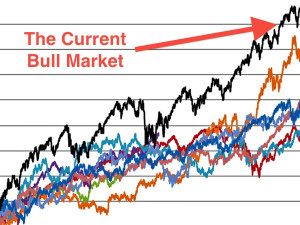

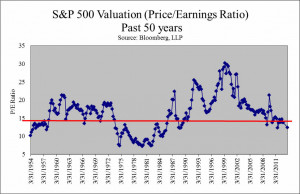

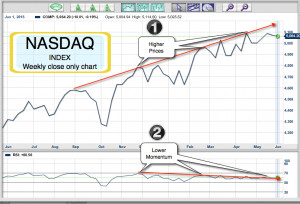

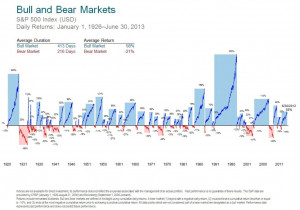

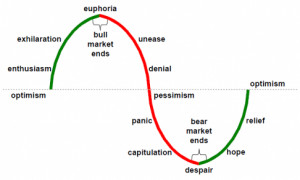

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.