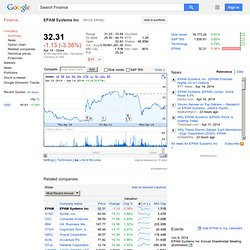

Financial System Quotes

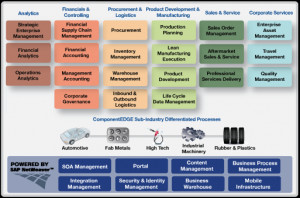

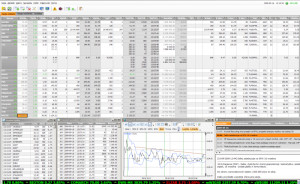

If the American government can't stand behind the dollar, the world's benchmark currency, then the global financial system will very likely enter a new era in which there is much less trade and much less economic growth. It would be, by most accounts, the largest self-imposed financial disaster in history.