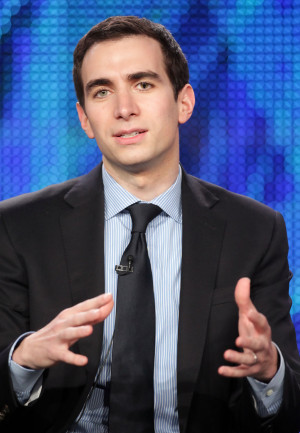

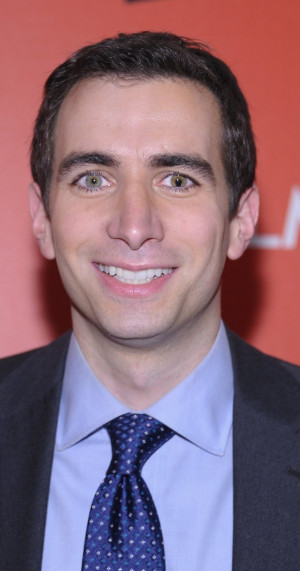

Andrew Ross Sorkin — American Journalist born on February 19, 1977,

Andrew Ross Sorkin is a Gerald Loeb Award-winning American journalist and author. He is a financial columnist for The New York Times and a co-anchor of CNBC's Squawk Box. He is also the founder and editor of DealBook, a financial news service published by The New York Times. He wrote the bestselling book Too Big to Fail and co-produced a movie adaptation of the book for HBO Films ... (wikipedia)

The moment a large investor doesn't believe a government will pay back its debt when it says it will, a crisis of confidence could develop. Investors have scant patience for the years of good governance - politically fraught fiscal restructuring, austerity and debt rescheduling - it takes to defuse a sovereign-debt crisis.

Debt, we've learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains - pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies - but all require one similar ingredient to create a true crisis: too much leverage.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.