Tax Increase Quotes

The move to tax Internet sales, clothed as a 'fairness' issue, is the typical 'wolf-in-sheep's-clothing' ploy so often used by governments unwilling to cut expenditures to match revenues. It matters not whether its proponents have a 'D' or an 'R' after their name. It is a tax increase in either case.

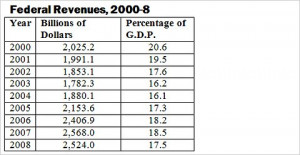

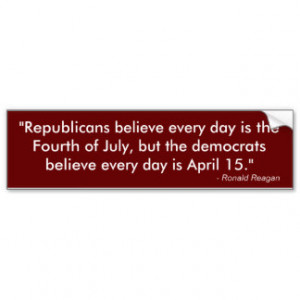

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

I traveled the state of Florida for two years campaigning. I have never met a job creator who told me that they were waiting for the next tax increase before they started growing their business. I've never met a single job creator who's ever said to me I can't wait until government raises taxes again so I can go out and create a job.

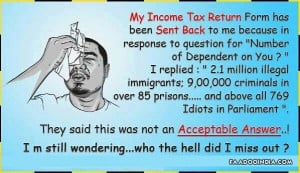

![Show slideshow]](https://cdn.quotesgram.com/small/57/93/469193385-new-tax-form.png)