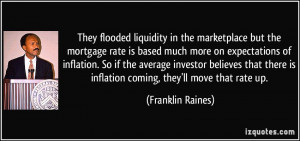

Liquidity Quotes

The Central Bank should have a permanent window for discounting high quality securities where banks could go and discount these. It gives peace of mind to the banks. In the absence of this facility, what banks tend to do is to keep a liquidity cushion for emergency requirements. This is a very expensive way of managing liquidity.