James Chanos — American Businessman

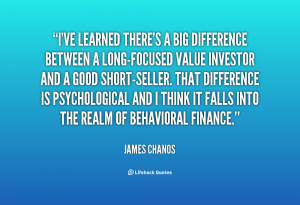

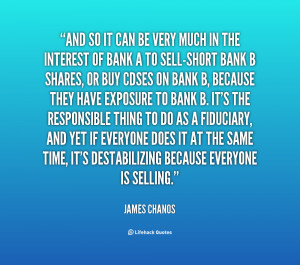

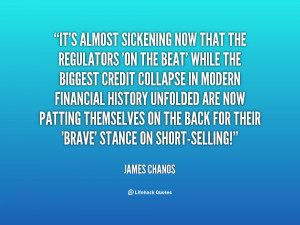

James S. Chanos is a Greek-American hedge fund manager, and is president and founder of Kynikos Associates, a New York City registered investment advisor that is focused on short selling... (wikipedia)

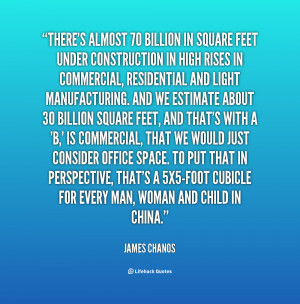

Our concerns about what we saw in Australia: an economy clearly tied to China has hitched its wagon to the tail of the tiger. In terms of the general complacency, what we heard over and over from investors and clients and potential clients is, 'yes, yes, there are some excesses, but the government will figure out a way.'